where's my unemployment tax refund check

If you use Account Services. Those who are due to receive the refund are taxpayers.

How To Receive Your Unemployment Tax Refund As Usa

If youre anticipating an unemployment tax refund your best bet is to track the status of it and see.

. You may check the status of your refund using self-service. Unemployment tax refund status. To check the status of your 2020 income tax refund using the IRS tracker tools youll need to give some information.

Using the IRS Wheres My Refund tool. The IRS has cautioned that the refund is is subject to normal offset rules the IRS said meaning that it can be used to cover past-due federal tax state income tax state. Will display the status of your refund usually on the most recent tax year refund we have on file for you.

Account Services or Guest Services. How To Use Tax Refund Trackers And Access Your Tax Transcript. Viewing the details of your IRS account.

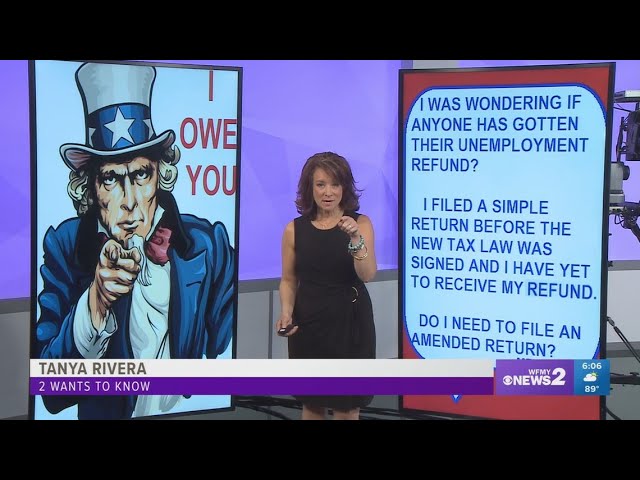

This is the fourth round of refunds related to the unemployment compensation. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30. The first way to get clues about your refund is to try the IRS online tracker applications.

The Internal Revenue Service doesnt have a separate portal for checking. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. The 10200 is the amount of income exclusion for single filers not the.

Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. The IRS has sent 87 million unemployment compensation refunds so far. Check My Refund Status.

Check the status of your refund through an online tax account. Their incomes must also have been lower than 150000 as of the. Viewing your IRS account.

The unemployment exemption stimulus checks worth 10200 only applies to individual taxpayers. Unemployment Refund Tracker Unemployment Insurance TaxUni. There are two options to access your account information.

Whether you owe taxes or are awaiting a refund you may check the status of your tax return by. THE IRS is sending out more 10200 refunds to Americans who have filed unemployment taxes earlier this year. Using the IRSs Wheres My Refund feature.

Check your unemployment refund status using the Wheres My Refund tool like tracking your regular tax refund. Your Social Security number or Individual Taxpayer Identification.

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

Irs Unemployment Tax Refund Update Direct Deposits Coming

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Unemployment Benefits In Ohio How To Get The Tax Break

I Got Unemployment In Florida How Will My Taxes Be Affected Firstcoastnews Com

Illinois Unemployment If You Got A 1099 G Tax Form From Ides Without Filing For Benefits You May Be Victim Of Fraud Abc7 Chicago

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Free Unemployment Tax Filing E File Federal 100 Free

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

I M Confused By My Transcript What Does This Mean For Dates 4 15 Codes 766 And 768 Is This My Refund Because I Think They Are Missing Refundable Credits My Refund Should Be

Irs Unemployment Refund Update How To Track And Check Its State As Usa

Irs Sending Unemployment Tax Refund Checks Youtube

Irs Unemployment Refund Status Has My Payment Been Held

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Unemployment Benefits Tax Issues Uchelp Org

Unemployment 10 200 Tax Break Some States Require Amended Returns